All Categories

Featured

Table of Contents

Additionally, as you handle your policy during your life time, you'll want a communicative and transparent insurance company. You can review customer testimonials on sites like Trustpilot and the Better Business Bureau to see exactly how receptive a business's consumer solution team is and how very easy it is to get payouts. We likewise advise taking a look at various other resources for client testament.

Universal life insurance coverage is an irreversible life insurance policy policy that supplies a survivor benefit and a cash money value element. As opposed to a whole life insurance policy plan, universal life insurance policy uses flexible premium settlements and often tends to be cheaper than a whole life plan. The main downsides of global life insurance plans are that they call for upkeep, as you should keep an eye on your plan's cash value.

Guaranteed Ul Insurance

Neither entire life or universal life insurance coverage is better than the other. Universal life insurance policy might draw in those looking for permanent protection with versatility and higher returns.

Our work is to supply the most comprehensive and reputable info so you can make the very best option. Our round-ups and reviews generally are composed of trustworthy companies. Monetary stamina and consumer contentment are trademarks of a qualified life insurance policy company. Financial strength demonstrates the capacity of a business to withstand any type of financial situation, like an economic crisis.

Additionally, the research study shows industry averages, showing which firms fall over and listed below industry averages. Access is additionally a main element we check out when reviewing life insurance coverage business. Ease of access describes a plan's affordability and addition of those in various threat courses (health classifications, age, lifestyles, and so on). No company wants to turn away sales, theoretically. equity indexed universal life policy.

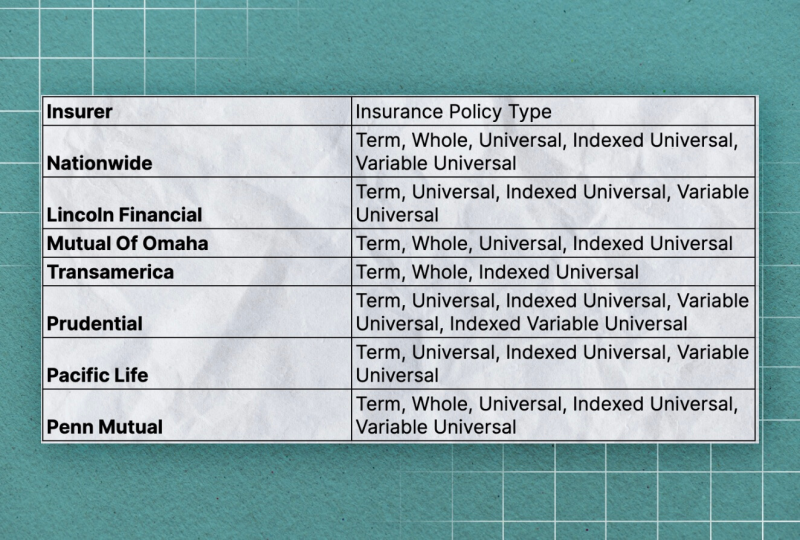

We use a company's web site to evaluate the expansiveness of its product line. Some business offer an exhaustive listing of lasting and temporary policies, while others only give term life insurance policy.

Guaranteed Death Benefit Universal Life Insurance

If your IUL policy has ample cash value, you can borrow versus it with adaptable settlement terms and reduced rates of interest. The alternative to create an IUL policy that mirrors your particular requirements and situation. With an indexed global life policy, you assign premium to an Indexed Account, consequently producing a Section and the 12-month Section Term for that section starts.

Withdrawals may occur. At the end of the sector term, each section makes an Indexed Credit scores. The Indexed Credit report is determined from the change of the S&P 500 * throughout that one- year duration and goes through the limits stated for that sector. An Indexed Credit report is computed for a section if value remains in the segment at sector maturity.

These limitations are established at the beginning of the sector term and are assured for the entire section term. There are four selections of Indexed Accounts (Indexed Account A, B, C, and E) and each has a various kind of limit. Indexed Account An establishes a cap on the Indexed Credit for a segment.

Iul Retirement

The development cap will certainly differ and be reset at the beginning of a section term. The participation rate figures out just how much of an increase in the S&P 500's * Index Value uses to sections in Indexed Account B. Greater minimal development cap than Indexed Account A and an Indexed Account Charge.

There is an Indexed Account Fee connected with the Indexed Account Multiplier. Despite which Indexed Account you choose, your cash money value is constantly safeguarded from negative market performance. Cash is moved at the very least once per quarter into an Indexed Account. The day on which that happens is called a move date, and this develops a Sector.

At Section Maturation an Indexed Credit rating is computed from the modification in the S&P 500 *. The worth in the Sector gains an Indexed Debt which is computed from an Index Growth Price. That growth price is a portion change in the existing index from the beginning of a Sector till the Sector Maturation day.

Sections automatically restore for an additional Sector Term unless a transfer is requested. Costs got since the last move date and any type of requested transfers are rolled into the very same Sector so that for any month, there will certainly be a single new Sector created for a provided Indexed Account.

Right here's a little refresher for you on what makes an IUL insurance coverage policy various from other sort of life insurance policy items: This is irreversible life insurance policy, which is necessary for companies that watch out for tackling more danger. This is since the policyholder will certainly have the insurance coverage for their entire life as it develops cash money worth.

Iul Life Insurance Cost

Interest is made by tracking a team of stocks chosen by the insurance provider. Danger analysis is an important component of harmonizing worth for the consumer without jeopardizing the company's success via the survivor benefit. On the other hand, most other sort of insurance policies just grow their cash worth via non-equity index accounts.

Plans in this classification still have cash money worth growth much more dependably due to the fact that they accumulate a rate of interest on a predetermined schedule, making it much easier to manage threat. Among the extra adaptable alternatives, this option is perhaps the riskiest for both the insurance provider and insurance policy holder. Supply performance establishes success for both the company and the client with index global life insurance policy.

While stocks are up, the insurance coverage plan would certainly do well for the policyholder, yet insurers require to continuously examine in with risk assessment. Historically, this threat has settled for insurance provider, with it being just one of the sector's most successful industries. "Indexed global life (IUL) brand-new costs rose 29% in the 4th quarter (of 2021, compared with the prior year," according to research firm LIMRA.

For insurance provider, it's very essential to reveal that risk; customer partnerships based on trust and dependability will help the company remain successful for longer, also if that company stays clear of a short windfall. IUL insurance plan may not be for every person to develop value, and insurance companies must note this to their clients.

Universal Life Policy Vs Term

When the index is doing well the value escalates previous most various other life insurance policies. If we take a look at the plunging market in 2020, indexed life insurance did not boost in policy value. This presents a risk to the insurance firm and specifically to the policyholder.

In this instance, the insurance provider would certainly still obtain the costs for the year, however the web loss would be better than if the proprietor maintained their plan., which excuses an IUL insurance plan from comparable federal policies for supplies and choices.

Insurance policy representatives are not financiers and should describe that the policy should not be dealt with as a financial investment. This develops client count on, commitment and satisfaction. Concerning 52% of Americans live insurance according to LIMRA. After the COVID-19 pandemic, even more people got a life insurance coverage plan, which raised death danger for insurance firms.

To be effective in the extremely affordable insurance policy profession, business require to take care of risk and prepare for the future. Anticipating modeling and data analytics can help establish assumptions.

Are you still not exactly sure where to begin with an actuary? Don't worry, Lewis & Ellis are right here to lead you and the insurance provider via the process. We have actually established a suite of Windows-based actuarial software to help our professionals and outside actuaries in successfully and efficiently completing many of their activities.

Latest Posts

Equity Indexed Universal Life Insurance Policy

Is Universal Life Whole Life

Life Insurance Stock Index